Beware of New Ag Finance Programs and REITs

- Grant Wiese

- Sep 5, 2023

- 2 min read

NE

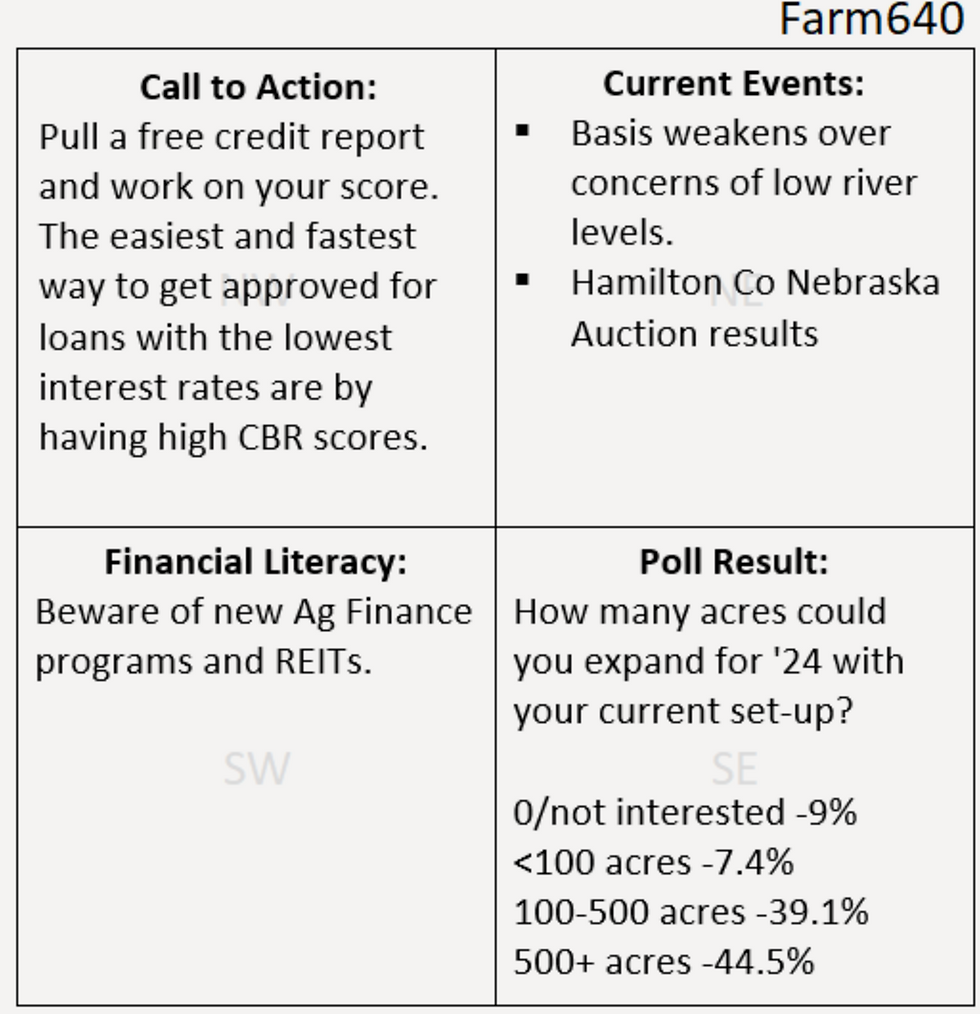

5 tracts sold at public auction on August 29th through BigIronRealty. Hamilton Co Nebraska ground located 1-5 miles north of Aurora, NE.

All tracts included a pivot in the sale.

155.6a = $16,200/a

143.15a = $15,900/a

160.12a = $15,150/a

160.41a = $15,550/a

80.89a = $13,450/a

SW

Beware of new ag finance programs and REITs. Agriculture has been highly profitable for several years now. Some studies show 2022 may have been the most profitable year for row crop producers in the Midwest in history. As a result, there are several new ag lending programs and REITs sprouting up to participate in ag and capture these high returns. In my area, south central Nebraska, it feels the investor interest has had a larger participation in land sales recently. Along with the individual investors, larger REITs (Real Estate Investment Trusts) are getting involved. REITs are companies that raise millions of dollars from multiple investors to buy real estate and earn returns. REITs have been around for a long time, but their participation in agriculture for my area feels new. Here is where you should have caution: A newly created (summer 2023) investment group is raising money to help local producers buy farms. They target producers who don’t have enough money to make a full down payment or are lacking equity. Traditional Purchase $1,000,000 purchase $350,000 down payment $650,000 financing over 20 yrs at 8% = payments roughly $67k/yr

Purchase with REIT $1,000,000 purchase $150,000 down payment $650,000 financing over 20 yrs at 8% = payments roughly $67k/yr $200,000 Invested equity from REIT over 10 yrs = payments roughly $20k/yr (unsure if they charge interest)

This tightens your cash flow considerably and now you are locked into an additional contract for at least 2 years. Between the 2-10 year window you can get out of the contract with the REIT, forcing them to remove the lien if you:

Complete the payoff of the original $200,000 AND get the farm reappraised. If the farm has appreciated in value, you must ALSO pay the REIT the new appraised value of their portion of appreciation on the ground.

Sell the farm.

You already bought the ground at market value once, which was most likely the highest price it has ever been worth. Now you must buy part of the ground AGAIN at a new, probably higher price to complete the payoff. Please read the fine print and talk to an attorney and lender before pursuing these types of transactions.