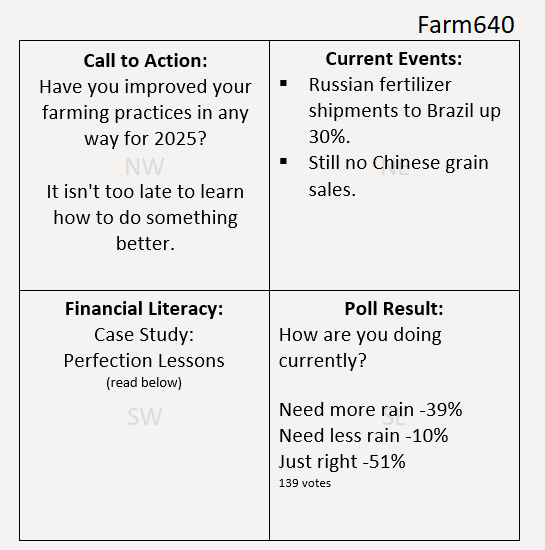

Case Study: Perfection Lessons

- Grant Wiese

- Jul 21, 2025

- 3 min read

SW Financial Literacy

Case Study: Perfection Lessons

Today we have a new operation cash flow case study to review.

Background:

Willy farms 1,000 acres of highly productive irrigated crop ground and recently broke away from his family’s larger operation. 350 of those acres are owned with the rest being rented from family on favorable terms. While he was previously farming with family and earning a $65k wage, he has always had his own equipment line which only covers his own acres.

Situation:

Willy just wants to know how he can be profitable again. Financial statements are very detailed and he knows his numbers well. Cash flow is updated in a personalized Excel document he created which has a tab for every field. It is a highly sophisticated document which allows him to get updated breakevens throughout the year. He has priced all inputs with multiple suppliers and has found ways to decrease his input expense by $30,000 compared to previous years. Still, his projected cash flow for 2025 is showing negative margins.

The Deal:

No deal at this point. Willy doesn’t want to work for nothing this year and would like to use black ink on his cash flow.

The Reality:

The operation is optimized for maximizing yield and income potential. This means the crop is planted with the best technology to allow it to be put in the dirt during the right window and with the best stand potential. It is then spoon fed nutrients with multiple passes and fertigation. An owned self-propelled sprayer is used to ensure coverage at the exact right time. Fungicide is also applied over several passes to ensure there is no disease in the crop. Harvest equipment has been updated to maximize crop weight by harvesting at ideal moisture levels.

Outcome:

To me here are the issues with this operation’s cash flow:

They have maximized gross income instead of maximizing net income. The operation has done an excellent job of squeezing every kernel out of their crop to get top yields. They also do an exceptional job of making sure they are paying the lowest dollar possible for the crop inputs. The problem is even by pricing everything down, they have surpassed the point of optimal profitability out of those inputs. It would be better for them financially to eliminate a few passes and pay less on inputs to allow for a slightly lower yield. Sometimes it is okay to have a field average of 255 bu/a instead of 260 bu/a if those last 5 bushels cost you $50/bu to achieve. That is what Willy is experiencing here.

Equipment! Willy’s equipment line would be sufficient for a 2,500/a operation, but he is only farming 1,100 acres. There is no need for a 16 row planter to be able to plant the entire crop in 5 days. Or a 40’ soybean head when you only have 200 acres planted. Or a self-propelled sprayer if you aren’t custom spraying for several neighbors. Even though debt payments aren’t overly high for Willy, his equipment line isn’t set up for the right purpose. His equipment line was built for top yield and lifestyle, not profitability.

Moving Forward:

Willy needs to rebuild his detailed Excel cash flow to maximize for profitability and be willing to try growing the crop with fewer inputs or passes. If the existing equipment line is going to stay in place, he should look to pick up significant custom hire work to generate income and support what he already has. If he is serious about turning a profit year over year, downsizing the sprayer and bean head would be good first steps to create liquidity and lower borrowing costs.

Need help with your operation's financials?

I have limited spots available for 1-hour consultations helping you:

Understand your farm's financial position.

Prepare for future growth opportunities.

Discuss purchase & finance options on farm transactions you are working through now.

Sign-up here if my services can benefit your operation:

Have a great week!

Grant